Managerial accounting involves identifying, measuring, analyzing, and interpreting an organization’s financial statistics to provide actionable financial intelligence in terms of key metrics for managers. It offers suggestions on the economic decision-making process of an organization. To provide as much beneficial information as possible, managerial accounting relies on a number of techniques. These techniques include forecasting, financial planning, and trend analysis, standard costing, budgetary control, funds flow analysis, and revaluation accounting.

- If you have some business acumen coupled with a head for numbers, a graduate certificate in management accounting is a great option for expanding your career potential.

- The analysis would consider the cost of goods sold (COGS) and the revenue generated from sales and determine if the business can fund this price increase or if a cheaper alternative is better.

- External parties need to be protected from the incompetence of a firm as they are the main users of financial accounting information.

- It compares the inflow and outflow of funds as documented in two comparative balance sheets.

Find out what courses you’ll take, skills you’ll learn and how to request information about the program. “Most of the job opportunities are in the private sector, which promotes entry-level accounting staff,” McLaughlin said. Ray H. Garrison (B.S. and M.S. Brigham Young University, D.B.A. Indiana University) is emeritus Professor of Accounting at Brigham Young University, Provo, Utah. As a certified public accountant, he has been involved in management consulting work with both national and regional accounting firms.

Optimization of cash flow ensures that a company has enough liquid assets to cover immediate expenses. Companies optimize cash flow so that they do not worry about future events and insufficient finances to complete them. Marginal Costing is another type of managerial accounting that deals with the cost of goods. It involves determining the impact of adding one additional unit of a product to the purchase or production order. External parties need to be protected from the incompetence of a firm as they are the main users of financial accounting information.

Develop career skills and credentials to stand out

Be prepared to start in an entry-level position in a finance department within an organization. Focus on gaining real experience in this role and finding opportunities to hone your skills to advance in management accounting. To become a management accountant, earn a degree in accounting, gain professional experience, and consider Certified Management Accounting (CMA) certification. Whether they are managerial accountants or financial accountants, they spend much of their time keeping the books. They are responsible for accurately recording every transaction that a company makes, whether it’s paying a contractor or buying a new machine. Students who choose the online MBA program at Boise State University have the opportunity to learn and apply the principles of managerial accounting by enrolling in BUSMBA 525.

Managerial accountants utilize performance reports to note deviations of actual results from budgets. The positive or negative deviations from a budget also referred to as budget-to-actual variances, are analyzed in order to make appropriate changes going forward. The most significant recent direction in managerial accounting is throughput accounting; which recognizes the interdependencies of modern production processes. For any given product, customer or supplier, it is a tool to measure the contribution per unit of constrained resource.

Learn How NetSuite Can Streamline Your Business

Given that the book covers the same material as my current managerial text but without the steep cost, I will strongly consider switching to this text. People (professionals) referenced in the examples were gender neutral with a representative balance. Splitting each concepts into smaller chunks/sections supplemented by relevant questions Managerial accounting and answers and examples would make the reading easy to the students. Financial accounting is created for its investors, creditors, and industry regulators. The path to becoming a managerial accountant isn’t easy, but it’s well worth the effort. Managerial accountants are the closest a company can get to hiring a fortune teller.

For small or sole proprietary businesses, the owner of a business is usually part of the management. Nonetheless, information from managerial accounting is used by the internal administrators of a company that make the decisions. Managerial accounting information is used by internal administrators of a business.

Managerial Accounting Methods

Funds flow analysis aims at providing an answer to the change in financial position as compared to other accounting periods. It compares the inflow and outflow of funds as documented in two comparative balance sheets. Standard costing involves the establishment of a standard total cost that is characteristic of efficient business operating conditions. Current costs of operation and goods or services are then compared to these standard costs. Forecasting is the act of predicting how financial situations will shape the future.

Margaret Shackell Joins Department as NCAA Faculty Athletics … – Ithaca College Athletics

Margaret Shackell Joins Department as NCAA Faculty Athletics ….

Posted: Thu, 03 Aug 2023 07:00:00 GMT [source]

Because of this managerial accounting in the U.S. must adhere to GAAP standards. Marginal costing (sometimes called cost-volume-profit analysis) is the impact on the cost of a product by adding one additional unit into production. The contribution margin of a specific product is its impact on the overall profit of the company.

For example, transfer pricing is a concept used in manufacturing but is also applied in banking. It is a fundamental principle used in assigning value and revenue attribution to the various business units. Essentially, transfer pricing in banking is the method of assigning the interest rate risk of the bank to the various funding sources and uses of the enterprise. Thus, the bank’s corporate treasury department will assign funding charges to the business units for their use of the bank’s resources when they make loans to clients.

While these would be desirable, this is not a huge shortcoming for this particular subject matter. The lack of a Table of Contents or chapter listing within the PDF of the book itself is an issue. Examples used in the chapter text lend themselves to being used a guides when students work on assigned problems from the end every chapter.

However, the table of contents presents a comprehensive detailed overview of the book’s chapters and related sections. The material coverage is as complete as the book I currently use, though presented in a slightly different order. I enjoyed seeing the review problems after each chapter section rather than all at the end of the chapter. I think students might be more likely to work the review problems in this manner as the questions appear more relevant when presented right after the applicable information.

Managerial Accounting Examples

It aims at presenting external stakeholders with information about the financial health of the company. Publicly held companies are required to complete all their financial accounts following GAAP standards to keep their public-traded status. Companies that also wish to get loans, entice investors, or fulfill debt covenants set by financial institutions also conform with the GAAP.

15 Superior Bookkeeping Software for 2023 – CitizenSide

15 Superior Bookkeeping Software for 2023.

Posted: Mon, 21 Aug 2023 06:14:38 GMT [source]

It allows businesses to identify and reduce unnecessary spending and maximize profits. The main objective of managerial accounting is to produce useful information for a company’s internal decision-making. Business managers collect information that feeds into strategic planning, helps management set realistic goals, and encourages an efficient directing of company resources. Financial accountants may come to mind when you think about accounting, but management accountants have different objectives. Managerial accountants engage in cash flow analysis to identify the impact of business decisions on the cash flow of a company. This cash flow concerns activities surrounding outflowing operational costs, outflowing investments, and in-flowing financing of a business.

Managerial Accounting Reports to Know

Companies are always looking for a competitive advantage, so they may examine a multitude of details that could seem pedantic or confusing to outside parties. This uniformity allows investors, lenders, and analysts to compare companies directly on the basis of their financial statements. Charlene Rhinehart is a CPA , CFE, chair of an Illinois CPA Society committee, and has a degree in accounting and finance from DePaul University. Contact a student success coach to learn more about the Boise State MBA program’s approach to managerial accounting and how it can benefit you in your career. There are plenty of different roles to choose from when it comes to managerial accounting.

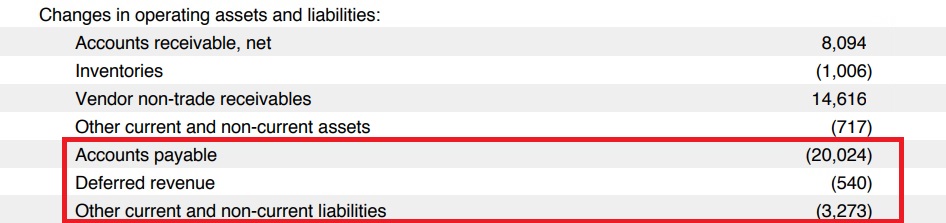

Some of these reports include budget managerial reports, account receivable aging reports, performance reports, and cost managerial accounting reports. Through this technique, managerial accountants ensure that the company’s true capital is determined, preserved, and maintained. Financial statements are made more accurate and forecasts for future asset valuation become easier and more reliable. Financial planning is a culmination of other techniques involved in achieving the internal goals of an organization. It involves the analysis of comparative financial statements and accounting ratios and the use of generated data to plan for the future. Proper cash flow analysis gives managerial accountants and administrators a chance to optimize the flow of cash within a company.

Some of the case studies may not age as well and could eventually date the book, but this is a hazard in any business text. Some of the discussions of information technology solutions might not remain relevant either. All Managerial Accounting topics that would typically be covered in an Accounting II course are also covered. The text does not cover the Financial Accounting topics that would typically be covered in an Accounting II course—but that is not an objective of the book. The text could stand alone as the sole text for a course in pure Managerial Accounting. Alternatively, the book could serve to cover the Managerial Accounting topics in a typical Accounting II course.

Financial leverage metrics analyze and determine the amount of borrowed capital that should be used to purchase assets to provide the maximum return on investment. This method provides transparency to key stakeholders so that they can see where the money goes and why. Financial professionals typically use reports like balance sheets and debt-to-equity ratios to help companies determine borrowed capital amounts. Within managerial accounting, several methods may be used to manage an organization’s finances.

Managers then use the generated information to optimize the whole business workflow to maneuver these constraints. The management of a business makes use of the information to evaluate and analyze a company’s performance and financial position. It also uses the information to make better financial decisions and prioritize business operations around fulfilling financial goals in terms of profitability and cash flow. Cash flow analysis studies the impact of a single financial decision or transaction to see the true impact of that purchase or decision. Financial professionals may look at several options and ways to finance a purchase based on that analysis. Cash flow analysis lets organizations make informed financial decisions and maintain sufficiently liquid assets in the short term.